How Corp CA Assisted Tax Filing Works for NRI?

Register

Step 1

Answer Basic Questions

Step 2

Talk with Tax Advisor

Step 3

Upload Documents

Step 4

Return filed by Corp CA

Step 5

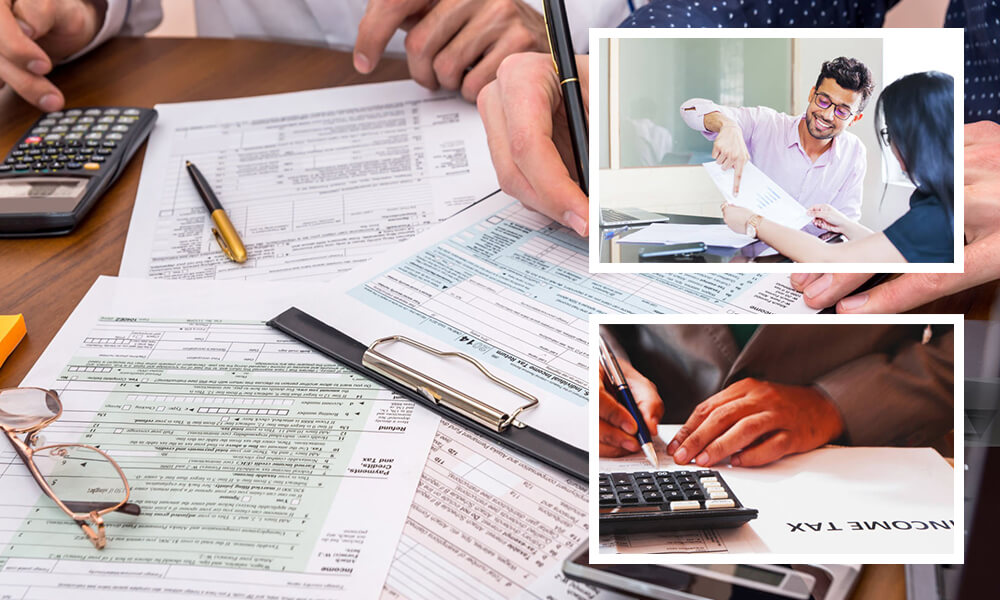

Expat Tax Preparation

Enjoy the excitement of living abroad while knowing that your taxes are in the more-than-capable hands of Corp CA, an experienced firm that handles expat taxes.

No matter how far you roam,

you can rest easy knowing that:

- Our expert CPAs are your trusted financial advisors

- Our sole focus is expat tax prep and planning

- No matter your situation, our expat specialist CPAs can help

- Our 4-step online process makes compliance for expat taxes easy

- Our strict privacy policy means your information is secure

- Our fees are fair, honest and extremely competitive

Corp CA Expat Tax Service

We help clients streamline the simple and navigate the complex. With our easy to reach team of tax experts, you are always one call or click away from getting the service that best fits your needs. We put in the work to maintain a depth of knowledge that ensures accountability and accuracy for our clients.

Secure

Our bespoke online platform is user-friendly, secure, and adapts to your circumstances.

Easy

Our talented and personable, highly-qualified CPAs and their support team are with you every step of the way.

Expert

Achieve your best outcome with a certified, world-class, expat-specialist CPA dedicated to you.

Flat Fees

No surprises! Our fee covers almost every tax return we file for our expat clients.

Start your expat tax preparation now!

Consult NowGetting started is easy

Register and connect with our tax expert.

Your CPA will let you know which documents and details to securely upload

Sit back and relax while your Corp CA CPA prepares your expat taxes

Approve a draft of your tax return, we eFile your taxes and you're done!

Get your taxes done right and your tax refund

100% accurate calculations, audit support, and your max refund.

Corp CA finds every tax deduction and credit you qualify for to boost your tax refund.

Corp CA calculations are 100% accurate so your taxes will be done right, guaranteed.

Frequently Asked Questions

Frequently asked questions by NRIs

Or

for 60 days in the financial year and for a total of 365 days in the preceding 4 years. There are certain exceptions to the above condition of 60 Days i.e. only the test of first condition is done in these cases:

- If you are an Indian citizen who has left India in the financial year as a crew member of an Indian ship or for the purposes of employment abroad; or

- If you are a Person of Indian Origin(PIO) or a citizen of India who comes on a visit to India;

- For Resident Individuals: Your Global income is taxable in India i.e. income earned whether in India or outside India is taxable in India.

- For Non-Resident Indians: Only income earned or accrued in India or deemed to be so is taxable in India. Therefore, your income from any country besides India is not taxable in India.

- PAN Card: Mandatory for filing taxes.

- Passport: For identity and nationality verification.

- Salary Slips & Form 16: Details of salary income.

- Bank Account Details: Indian account for tax refunds.

- Investment Details: Declare Indian investments.

- Tax Payment Receipts: Proof of tax payments.

- Foreign Assets Info: Details of foreign accounts/investments.

- Rent Receipts: If earning rental income.

- Indian Property Details: Information on owned property in India.

Additional documents may be needed based on specific circumstances, like TDS certificates or agricultural income details.

In case your property is 3 years (2 years from F.Y 2017-18) old, then long term capital gain will arise on the event of sale. On such gains, tax is payable @ 20% .However, you can reduce your tax liability using investment options given under various provisions to save yourself from payment of capital gain tax.

Tax implications for NRIs are also applicable in the case of inheritance. In case the property has been inherited, remember to consider the date of purchase of the original owner for calculating whether it’s a long term or a short term capital gain. In such a case the cost of the property shall be the cost to the previous owner.

Articles

Recent help articles from our Tax Experts

Convert your resident savings account to an NRO account

If you have sources of income in India or you need to conduct any banking or financial transactions, you will need to hold an NRO account.

Read More

How to Apply for a Corporate Tax Refund in the UAE

Corporate tax in the UAE is self-assessed, which implies that firms are required to compute and report their taxes correctly. Taxable persons compute their taxes using the taxable income and the existing rates of tax, which makes it easier and reduces the use of paper.

Read MoreContact Us

Please fill the given form, we will reach to you as soon as we recive your request.

Get in touch

Get a customized quote as per your requirement and free consultation with our NRI tax expert.

Location:

The Corporate CA Service

Spaces, 25 Cabot Square, London E14 4QZ

Call:

+44 7413 619 819

+44 20 7993 4969

Email:

corpca@corporateca.com